How Stonewell Bookkeeping can Save You Time, Stress, and Money.

Wiki Article

Stonewell Bookkeeping Things To Know Before You Buy

Table of ContentsThe Greatest Guide To Stonewell BookkeepingSome Known Facts About Stonewell Bookkeeping.The Basic Principles Of Stonewell Bookkeeping All about Stonewell BookkeepingThe Buzz on Stonewell Bookkeeping

Here, we address the question, just how does accounting aid a business? The true state of a company's finances and cash flow is constantly in change. In a feeling, accountancy books represent a picture in time, however just if they are upgraded often. If a company is absorbing bit, an owner must take activity to boost revenue.

It can additionally fix whether or not to raise its very own compensation from clients or consumers. Nevertheless, none of these conclusions are made in a vacuum cleaner as valid numerical info must buttress the economic choices of every small company. Such information is put together with bookkeeping. Without an intimate expertise of the characteristics of your capital, every slow-paying client, and quick-invoicing financial institution, becomes an event for anxiety, and it can be a tedious and dull task.

Still, with correct cash flow administration, when your publications and journals depend on day and systematized, there are far fewer enigma over which to worry. You recognize the funds that are offered and where they fall short. The news is not constantly good, yet at the very least you understand it.

8 Easy Facts About Stonewell Bookkeeping Explained

The puzzle of reductions, credit reports, exemptions, timetables, and, of training course, charges, suffices to simply surrender to the internal revenue service, without a body of efficient documentation to sustain your insurance claims. This is why a devoted bookkeeper is very useful to a little organization and deserves his or her weight in gold.

Your company return makes claims and representations and the audit targets at verifying them (https://www.slideshare.net/stonewellbookkeeping?tab=about). Great accounting is all about linking the dots in between those depictions and truth (franchise opportunities). When auditors can adhere to the information on a ledger to invoices, bank declarations, and pay stubs, to name a couple of files, they promptly find out of the expertise and honesty of business company

The 4-Minute Rule for Stonewell Bookkeeping

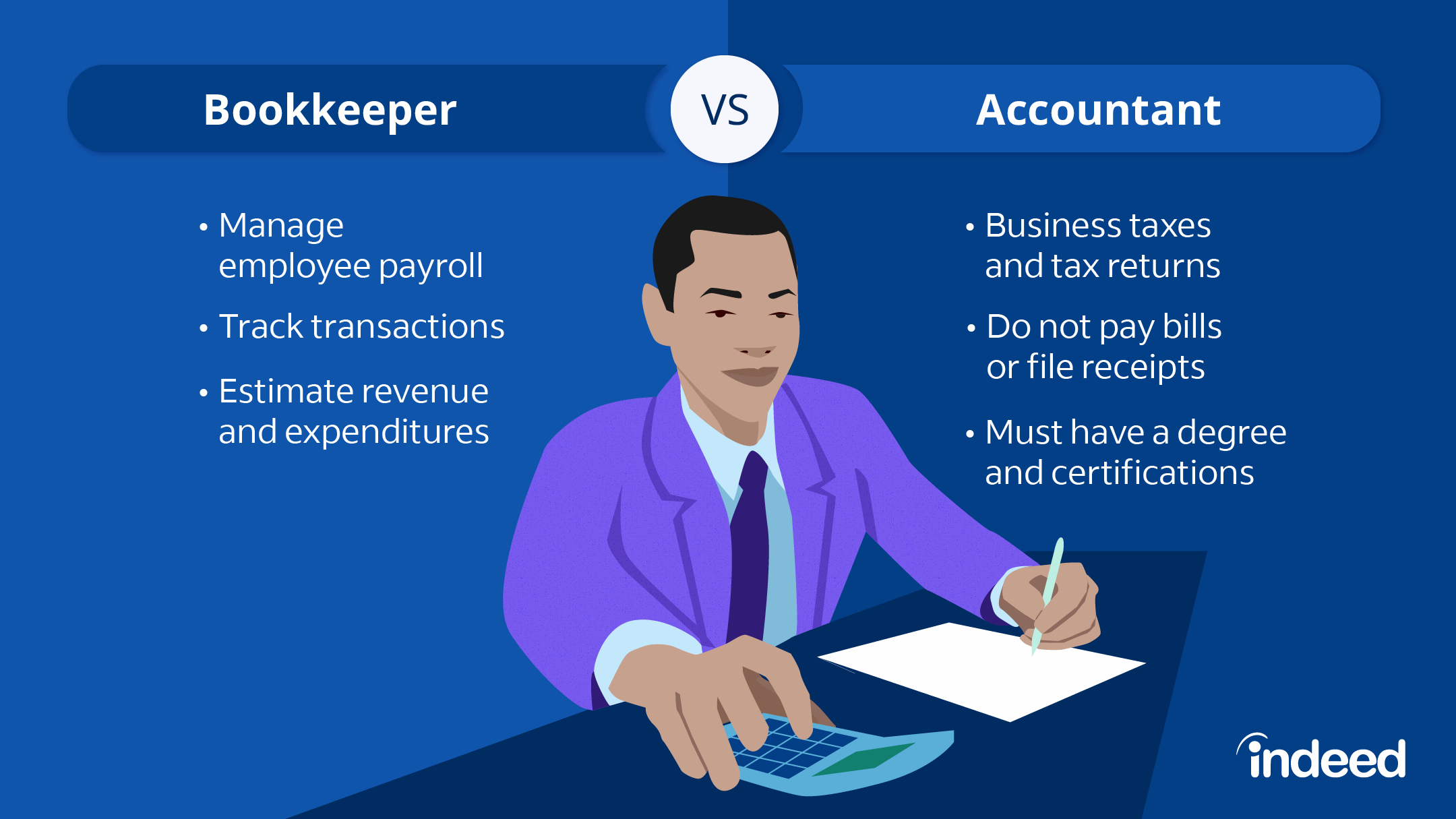

In the very same way, slipshod bookkeeping includes to tension and anxiousness, it additionally blinds entrepreneur's to the possible they can realize over time. Without the information to see where you are, you are hard-pressed to establish a destination. Just with understandable, detailed, and valid information can a company owner or monitoring group story a training course for useful content future success.Company owner understand finest whether an accountant, accounting professional, or both, is the appropriate service. Both make essential contributions to an organization, though they are not the exact same profession. Whereas an accountant can collect and arrange the details needed to sustain tax obligation preparation, an accountant is much better suited to prepare the return itself and truly analyze the income statement.

This short article will certainly delve into the, including the and exactly how it can profit your business. Bookkeeping involves recording and arranging financial purchases, consisting of sales, purchases, payments, and receipts.

This short article will certainly delve into the, including the and exactly how it can profit your business. Bookkeeping involves recording and arranging financial purchases, consisting of sales, purchases, payments, and receipts.By routinely upgrading monetary records, accounting helps organizations. Having all the financial information easily accessible maintains the tax obligation authorities pleased and stops any kind of last-minute headache during tax filings. Regular bookkeeping guarantees well-kept and orderly documents - https://www.lidinterior.com/profile/stonewellbookkeeping7700262003/profile. This helps in quickly r and saves companies from the stress of looking for records throughout target dates (bookkeeping services near me).

Rumored Buzz on Stonewell Bookkeeping

They likewise want to know what possibility the service has. These elements can be conveniently taken care of with bookkeeping.By maintaining a close eye on economic records, services can establish realistic goals and track their progression. Normal accounting guarantees that companies stay compliant and avoid any type of charges or legal problems.

Single-entry accounting is basic and functions finest for small companies with couple of purchases. It entails. This technique can be compared to maintaining a basic checkbook. It does not track properties and responsibilities, making it much less extensive compared to double-entry accounting. Double-entry bookkeeping, on the various other hand, is a lot more sophisticated and is normally thought about the.

.jpg?token=7cd2150746d7a6091d181e6f1b4de871)

Indicators on Stonewell Bookkeeping You Need To Know

This could be daily, weekly, or monthly, depending on your organization's dimension and the volume of purchases. Don't be reluctant to look for aid from an accountant or bookkeeper if you locate handling your financial records challenging. If you are looking for a free walkthrough with the Accountancy Solution by KPI, call us today.Report this wiki page